Big tech was slammed Friday as investors took profits from the group, which some fear has become a massive market bubble.

The sell-off accelerated in afternoon trading, with the Nasdaq falling 2.4 percent, and names like Facebook and Apple, down 4 percent. The S&P tech sector was down 3.3 percent Friday but was still up 18 percent for the year.

Goldman Sachs on Friday released a report on the top five outperforming mega-cap names in tech with some warnings on valuations and concerns that their volatility has become extraordinarily low. In fact, the stocks had become closely correlated to safe haven plays, like bonds and utilities.

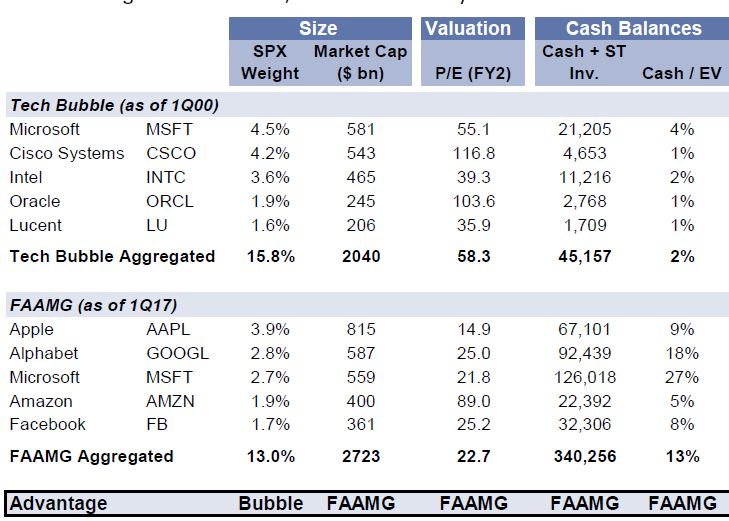

Goldman studied the valuations of the tech leaders, known as the FAAMG — for Facebook, Amazon.com, Apple, Microsoft and Alphabet (Google). (It left out Netflix from the original FANG, since its impact on the S&P 500 is still too small.)

What it found is that the current-day tech stocks have advantages in cash flow, valuation and cash balances over the top five tech names in the first quarter of 2000 — just before the bubble burst. But the current group is behind in profitability, as measured by gross profits and total assets. The tech bubble names Goldman studied included Lucent, Cisco, Oracle and Intel. Microsoft was the only stock to make both lists

The FAAMG names have added a total of $600 billion of market capitalization this year — the equivalent of the GDP of Hong Kong and South Africa combined, says Goldman. The group makes up about 13 percent of the S&P 500, but has accounted for almost 40 percent of its year-to-date performance. The stocks are among the top holdings of hedge funds. The analysts noted that mutual funds, aimed at core, growth and value, are overweight all but Apple, and the five companies combined are 11.8 percent of those mutual fund holdings.

The analysts said that momentum and growth as market factors are elevated and the tech names are appealing because investors may be looking for opportunities that are not dependent on policy changes in Washington.

UBS also commented on the FAAMG group of big tech stocks Friday. Julian Emanuel, equity and derivatives analyst, still likes tech but says they could be vulnerable in the near term as investors rotate to other groups.

“That could be a short-term headwind given the outperformance. But the long-term earnings growth story remains intact,” he said. Emanuel noted there were four times when a handful of tech names became so powerful. Twice, it ended badly—after 1999 and 2007. But they also were leaders in 1993 and 2005.

He said it’s notable that on the previous occasions, Microsoft fell 62.8 percent after the 2000 bubble and was down 45.4 in the financial crisis in 2008. “Such declines now appear as blips on a long-term chart,” Emanuel noted.

The FAAMG group does break some historic trends. Goldman Sachs says the volatility in the FAAMG bloc is lower than not only the S&P 500, but the staples sector and utilities. The group continues to be closely tied to tech and discretionary stocks, but it has also started trading more with the other sectors following the U.S. election and its correlation to staples and utilities is at a five-year high.

“Steady sales growth, rising cash balances and limited market shocks have dampened realized volatility to the point that they now look more like consumer staples than tech stocks. If FAAMG was its own sector it would screen with the lowest realized volatility,” the Goldman analysts wrote.

But they also noted that investors are using the group as a bond proxy. “Since November, correlation has turned negative suggesting that higher bond yields, typically associated with stronger growth, will weigh on stocks while falling bond yields are a good thing,” they said, adding it runs counter to history.

While they may be loved, today’s tech darlings aren’t without potential flaws.

“We believe low realized volatility can potentially lead people to underestimate the risks inherent in these businesses including cyclical exposure, potential regulations regarding online activity or antitrust concerns or disruption risk as they encroach into each other’s businesses,” the Goldman analysts noted.

Momentum in the group “has built a valuation air pocket” and is “creating cause for pause,” they wrote.

“The fear is that if fundamental events cause volatility to rise, these same passive vehicles will sell and exacerbate downside volatility,” they added. Goldman points to a warning in the options markets, which is pricing in more volatility for the companies when looking at options three months out, and prices suggest the FAAMG stocks would be more volatile than the average stock in 6 of 9 major sectors, including tech.

Free cash flow for FAAMG has plateaued after doubling between 2006 and 2016, and at the same time the group has increased capital expenditures to 17 percent while cash flow from operations grew at less than 10 percent. Cash levels have also plateaued as a percent of market cap.

Comparison of FAAMG stocks to 2000 tech bubble leaders

Source: Goldman Sachs

But when looking back at the year 2000, all five companies have eight times more cash than the big tech stocks had in the bubble. Free cash margins are modestly better than the tech bubble companies but yields are higher.

Goldman said that the gross profits and total assets were significantly higher for the tech bubble names and that could be because today’s businesses have become more capital intensive. Return on invested capital was also higher but that may be because companies now are using accelerated depreciation.

As for size, the FAAMG stocks are almost 30 percent bigger and they aren’t as large a portion of the S&P, 13 percent compared with 15.8 percent in 2000. FAAMG is an even larger 43 percent of Nasdaq and provided 55 percent of its gains so far this year.

During the bubble, the five largest tech names were trading at almost 60 times two-year forward earnings, with the cheapest stock trading at 36 times. Now FAAMG trades at 23 times forward two-year earnings with only one, Amazon, over 30 times.

Watch: Pro says tech needs to add value through products

Techosta Where Tech Starts From

Techosta Where Tech Starts From